What Is The UK State Pension?

What is the State Pension?

As we approach retirement, many of us would rest easy knowing we have a large enough nest egg to see us through our golden years. The age of Defined Benefit or Final Salary pensions is coming to an end for most, besides those of working in the public sector. And so, without shelling out for an annuity, guaranteed income in retirement is harder to come by.

Thankfully, for most UK taxpayers, guaranteed income in retirement can be secured by way of the State Pension. Although taxable, this provides a regular income, for life, though not all of us are eligible.

When can I receive the State Pension?

Your state pension age is the earliest you can start claiming your State Pension. But it's not a one-size-fits-all arrangement – your State Pension age depends on when you were born.

There are some changes happening right now to the State Pension age: If you're approaching that milestone today, both men and women will need to wait until they reach age 66 before they can claim their state pension.

For those of us born after April 5th 1960, we’ll need to wait until age 67 before claiming the state pension. There's a continuing phased increase in the State Pension age – with the Government expecting it’ll climb to 68 between 2044 and 2046. The Pensions act of 2014 allows the government to review the state pension age at least once every 5 years, so keep an eye on these changes.

To put this into perspective, if you’re aged between 47 to 63 now, you can claim your state pension at age 67 between 2026 and 2043. If you’re aged 45 to 46, you can expect to claim your state pension at age 68 between 2044 and 2046. There are already recommendations for the state pension age to increase to 69 between 2046 and 2048, meaning those of us aged 43 to 44 will possibly need to wait a year longer. Those of us younger than 43? Your guess is as good as ours.

It’s important not to confuse your state pension age with your NMPA or ‘Normal Minimum Pension Age’. They’re often confused, but they're totally different things. The NMPA, currently age 55, is the age at which you can access your personal pensions.

How much State Pension will you receive?

For the 2024/25 tax year, the full State Pension is set at £221.20 a week. That adds up to an annual income of £11,502.40. The amount you actually get might be lower, depending on your National Insurance record.

Unfortunately, the State Pension is liable to income tax but is paid gross, that is, before tax is deducted. This means that although tax isn’t deducted from the State Pension, it will use up some of your tax-free personal allowance.

In the current 2024/25 tax year, we have a tax-free personal allowance of £12,570. By receiving the full State Pension, you’ll make use of £11,502.40. This leaves you with a measly £1,067.60 personal allowance, so expect to pay more income tax if you have taxable earnings over this amount.

To get any State Pension at all, you’ll need a minimum amount of National Insurance contributions or ‘credits’. To bag the full amount of £221.20 a week, you’ll need at least 35 years on your record.

In some cases, your State Pension could be higher than £221.20 a week. If you’re one of the lucky ones, it means you have what’s called a ‘protected amount’. This typically happens if you built up an entitlement to Additional State Pension under the old system.

Who qualifies for the State Pension?

For anyone hitting State Pension age after April 6, 2016, you need at least ten years of National Insurance contributions or credits to even qualify for the State Pension. There’s no free lunch.

But if you want the full shebang – £221.20 a week – you’ll need to have paid or been credited with at least 35 years of National Insurance contributions.

Each year you’ve contributed gives you 1/35th of the full amount. Here’s what that looks like:

If you’ve got a solid 35 years under your belt, you’re golden. That’s 35 out of 35 times £221.20, which means you get the full £221.20 a week.

Let’s say you’ve got 20 years – still pretty good: you’ll get 20 out of 35 of £221.20, which comes out to £126.40 a week.

And if you’re just scraping by with the minimum 10 years, you’ll receive 10/35ths of £221.20, giving you £63.20 a week.

This goes to show that when claiming your state pension, every year counts.

Who qualifies for the State Pension?

If you’re aiming for the full State Pension but don’t quite have the 35 years of National Insurance contributions, lets take a look at a taxpayers options:

You can make voluntary contributions through Class 3 National Insurance. And for the self-employed, you can top up via Class 2 National Insurance contributions.

If you’re falling short as you approach State Pension age, you can buy qualifying years to top up your entitlement. For the self-employed, a full National Insurance year costs £179.40 under Class 2. If you’re making Class 3 contributions, it’s quite a bit pricier at £907.40 per year.

Each full year you buy adds an extra £6.32 to your weekly State Pension. That’s an additional £328.64 annually. A bargain for the self-employed.

If you’re buying a qualifying NI year under Class 3, you’ll break even after about 2 years and 9 months of receiving your State Pension. For those grabbing extra years under Class 2, you’ll make your money back within the first year, with change.

Before tying up your capital to top-up your state pension, it’s worth considering how long you expect to receive it. If you’re in poor health, buying extra years may be a bad idea if you’re unlikely to survive 3 years. Especially as your state pension usually doesn’t continue in payment once you’re gone.

Does the State Pension increase once in payment?

The State Pension typically gets an increase at the start of every tax year on 6 April. But how much does it go up? Well, that’s decided by whichever is the highest of these three:

The average percentage increase in prices, or inflation, as measured by the Consumer Price Index (CPI) for September of the previous year.

The average increase in wages, measured from July to July of the previous year.

Or A flat 2.5%.

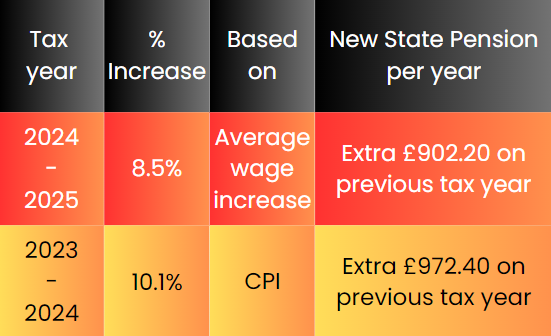

This is what is referred to as the “triple lock” guarantee. For example, in 2023, CPI was 6.7% and the average wage increase was a solid 8.5%. So, in April 2024, the State Pension got a considerable 8.5% bump-up, jumping from £203.85 to £221.20 per week, or a £902.20 increase for the year. Pretty generous but not as generous as the 10.1% increase state pensioners received in April 2023 due to runaway inflation.

But, as always, there are a couple of exceptions to the rule. The first is the Additional State Pension – part of the old State Pension that you might get if you reached state pension age before 6 April 2016. The second is any extra amount you get if you decided to delay taking your State Pension, also known as deferring, we’ll come onto this later. These two exceptions only increase in line with CPI.

Now, while there are no current plans to scrap the triple lock, it’s a hot topic of debate. Why? Well, the increases can get pretty hefty – like the 10.1% rise in 2023 and 8.5% in 2024 – and that costs the government billions.

Legally, the government only has to increase the State Pension in line with the average wage increase. This means they could decide to ditch the triple lock in the future. Making such a change would be a majorly unpopular political move, so it’s not something that would happen overnight.

Why do people defer their State Pension?

You don’t get your State Pension automatically, you have to claim it. You have two options: you can either claim your State Pension right away or decide to delay, also known as deferring. If you choose to defer, there’s nothing you need to do. Your pension will automatically be deferred until you decide to claim it. Deferring your State Pension can increase the payments you receive when you do claim it.

If you're reaching State Pension age on or after 6 April 2016, here’s how it works: your State Pension will increase every week you defer, as long as you defer for at least nine weeks. For every nine weeks you put off claiming, your State Pension goes up by the equivalent of one per cent. That adds up to just under 5.8 per cent for every year you defer. This extra amount is then added to your regular State Pension payments.

Let’s look at an example: Say you’re entitled the full new State Pension, which is £221.20 a week. By deferring for a year, you’d earn an extra £12.83 a week, or £667.16 for the year, a healthy increase.

While you can technically keep deferring your State Pension indefinitely, it’s generally not a great idea to do so for more than a few years, depending on your circumstances. The longer you defer, the harder it becomes to recoup the money you’ve missed out on. So, while a little patience can pay off, too much might leave you short-changed.

Get in touch

Do you have a question about the State Pension? We’re here to make it simple. Leave us a message via the submission form button below, and let’s chat. We’re always happy to help.

No financial decisions should be taken based on the content of this website or associated videos. The guidance contained within this website is subject to the UK regulatory regime and is therefore primarily aimed at viewers in the UK. Always take full individual advice first. Regulations and legislation governing taxation, investments and pensions may change in the future.

The content on this page is accurate as of the 2024-25 tax year.